Indiana House Bill 1002 – aka “Transportation infrastructure funding”, or better known as a “Gas Tax Increase” – adds a dime per every gallon of gasoline sold in Indiana on July 1, 2017 and beyond.

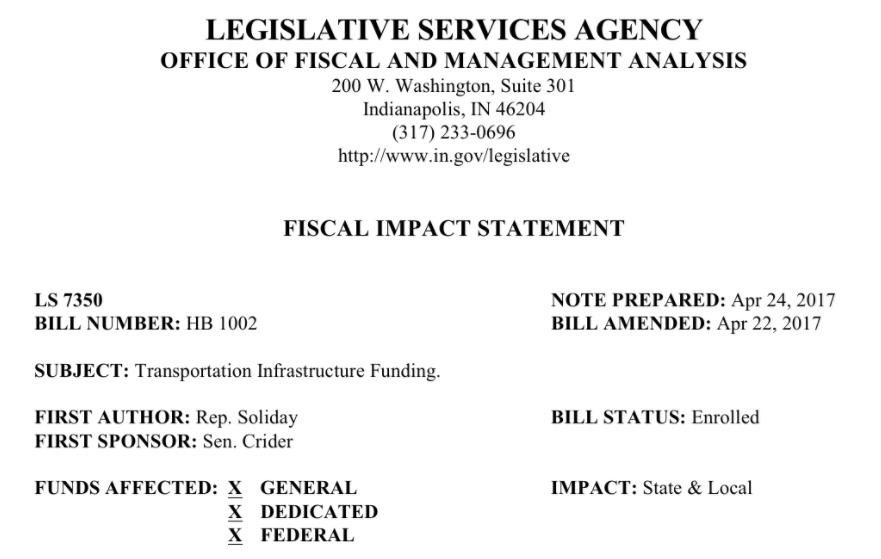

The boring lawyer/politician version reads as follows:

Provides for a one-time fuel tax rate increase using a multiyear index factor based on the last time the particular fuel tax rate was increased and the current fuel tax rate per gallon. (Gasoline tax is currently $0.18, special fuel tax is currently $0.16, and motor carrier surcharge tax is currently $0.11.) The bill limits the one-time increase to $0.10 per gallon. It provides for an annual rate increase in fuel tax rates based on an annual index factor. It also limits the annual rate increase based on the annual index factor to $0.01 per gallon. The last index factor adjustment to the fuel tax rates is July 1, 2024.

In other words, they’re raising gas taxes by 10-cents on July 1, 2017. And it allows them to raise the tax by a penny for the next seven years (if I’m reading that right).

Bottom line, the total gas tax in Indiana will increase to 40.8 cents per gallon as of July 1, 2017. Oh, joy!!!

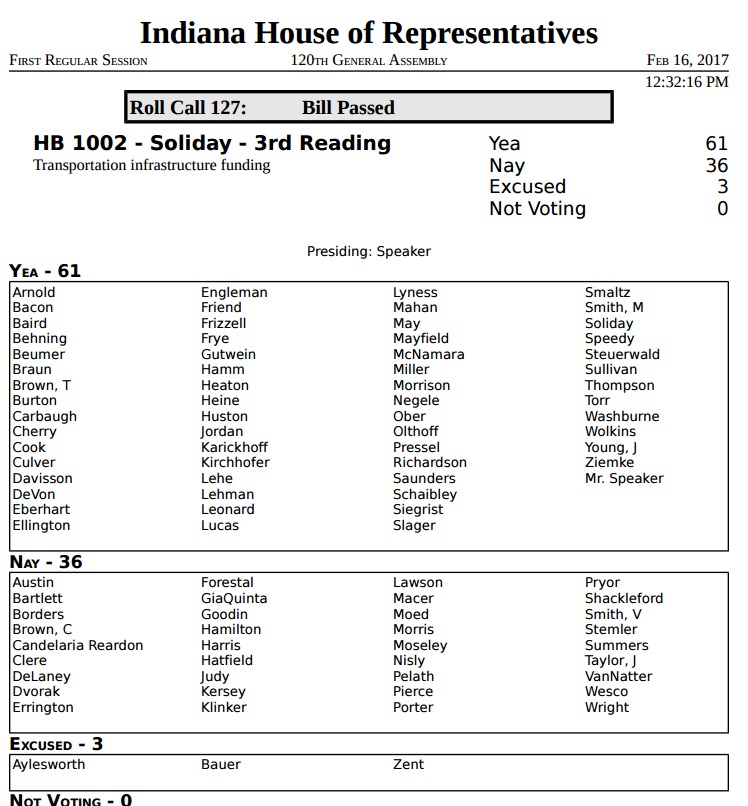

I Didn’t Vote For This

If you’re wondering how your representative voted on this matter, here you go.

Disappointing Bacon

The most disappointing thing about this? Someone named “Bacon” voted for this. Ron Swanson would not be pleased.

So there you have it. You might need to buy a tanker truck today and fill up.